What is Swing Trading?

What is Swing Trading? Mastering the Art of Riding Market Waves

If you’ve ever been intrigued by the fast-paced world of stock trading, you may have come across the term “swing trading.” But what exactly is swing trading, and how does it differ from other trading strategies? In this article, we will dive into the exciting world of swing trading, exploring its definition, techniques, and potential benefits. So, if you’re ready to ride the waves of the market like a pro, let’s uncover the secrets of swing trading.

Defining Swing Trading

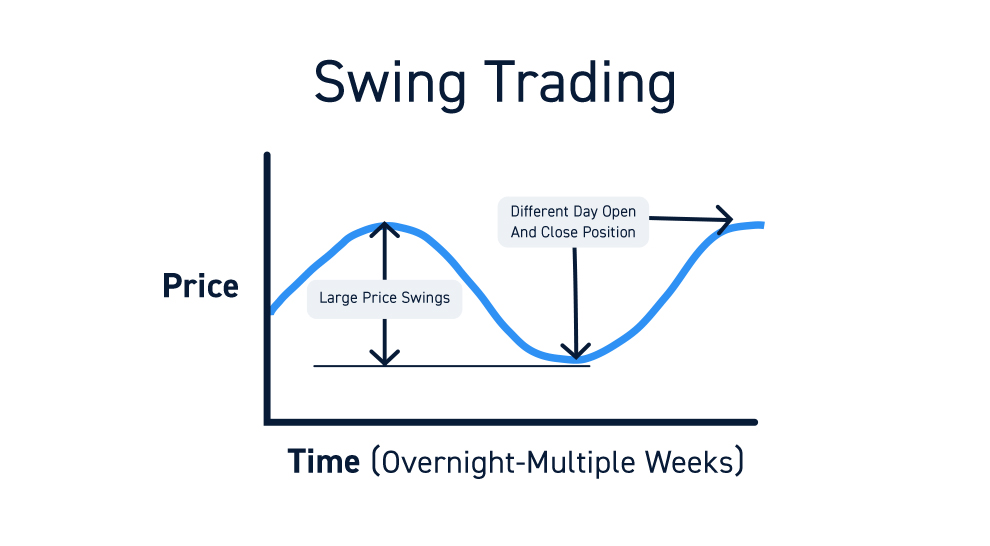

Swing trading is a trading style that aims to capture short-to-medium-term price movements in financial markets, such as stocks, commodities, or currencies. Unlike long-term investors who hold onto assets for months or years, swing traders take advantage of price fluctuations that typically occur over a few days to a few weeks. In other words, swing traders ride the waves of market momentum, aiming to profit from both upward and downward price swings.

Riding the Market Waves

To grasp the essence of swing trading, picture yourself on a beach, eagerly anticipating the perfect wave to ride. Just as a skilled surfer catches waves at their peak, swing traders seek opportunities when a stock or other asset is about to experience a significant price movement. These movements can be triggered by various factors, such as earnings reports, news events, or changes in market sentiment. The goal is to enter a trade at an opportune moment and ride the momentum until the price movement begins to fade.

Key Characteristics and Techniques

Successful swing trading requires a combination of skill, discipline, and a keen eye for market trends. Here are some key characteristics and techniques employed by swing traders:

- Technical Analysis: Swing traders heavily rely on technical analysis, using charts, indicators, and patterns to identify potential entry and exit points. They examine historical price data, support and resistance levels, moving averages, and oscillators to make informed trading decisions.

- Short-to-Medium-Term Trades: Unlike day traders who close their positions by the end of the trading day, swing traders hold onto their trades for a few days to a few weeks. This allows them to capture larger price movements while avoiding the stress of constant monitoring.

- Risk Management: Effective risk management is paramount in swing trading. Setting stop-loss orders to limit potential losses and employing proper position sizing strategies are crucial for preserving capital and managing risk.

- Patience and Discipline: Swing trading requires patience and discipline. Not every trade will be a winner, and it’s important to stick to your trading plan and avoid impulsive decisions driven by emotions.

Potential Benefits of Swing Trading:

Swing trading offers several potential benefits that attract traders seeking active participation in the market:

- Flexibility: Swing trading can be adapted to different market conditions, as it doesn’t rely solely on a bull or bear market. Whether prices are rising or falling, swing traders can profit from short-term price movements.

- Time Commitment: Unlike day trading, swing trading doesn’t demand constant monitoring of the market. This makes it suitable for individuals with other professional or personal commitments.

- Potential for Higher Returns: By capitalizing on larger price movements, swing traders have the potential to achieve higher returns compared to long-term investors.

In conclusion, swing trading is a dynamic trading style that allows traders to ride the waves of market volatility and profit from short-to-medium-term price movements. By employing technical analysis, managing risk, and maintaining discipline, swing traders aim to seize opportunities and generate consistent profits. While swing trading may not be suitable for everyone, those who are willing to put in the effort and master the art of market surfing can potentially reap the rewards. So, if you’re ready to dive into the exciting world of swing trading, buckle up and get