What Is Futures Trading?

What Is Futures Trading? An Insider’s Guide to Navigating the Financial Market

If you’ve ever been captivated by the hustle and bustle of Wall Street or wondered how traders make money in the fast-paced world of finance, then you’ve likely come across the term “futures trading.” But what exactly is futures trading, and how does it work? In this article, we’ll break down the basics of futures trading, shedding light on this exciting avenue for investors to profit from price fluctuations in various markets.

Understanding the Concept

At its core, futures trading is a financial instrument that allows traders to speculate on the future price movements of assets such as commodities, currencies, or even stock market indices. It offers an opportunity for individuals to profit from both rising and falling markets, making it a versatile tool in the hands of astute traders. So, how does it work? Well, imagine you’re a farmer planning to harvest corn in a few months. You’re concerned that the price of corn might drop by the time you’re ready to sell your crop. To mitigate this risk, you could enter into a futures contract, essentially agreeing to sell your corn at a predetermined price on a specific date in the future. This contract serves as a binding agreement between you and another party, typically facilitated through a regulated exchange, ensuring that you’re protected against potential price fluctuations.

Benefits and Risks

Futures trading offers several advantages for investors. Firstly, it provides a way to hedge against price volatility, enabling individuals and businesses to manage their exposure to potential financial losses. Additionally, futures trading allows for leverage, meaning you can control a larger position in the market with a smaller amount of capital. This leverage amplifies both profits and losses, so it’s crucial to approach it with caution and proper risk management strategies. However, like any investment vehicle, futures trading carries its share of risks. Markets can be unpredictable, and if you don’t have a solid understanding of the underlying asset or fail to stay informed about market trends, you could incur substantial losses. It’s crucial to conduct thorough research, stay updated with relevant news and analysis, and consider seeking advice from experienced traders or financial professionals before diving into the world of futures trading.

Market Opportunities

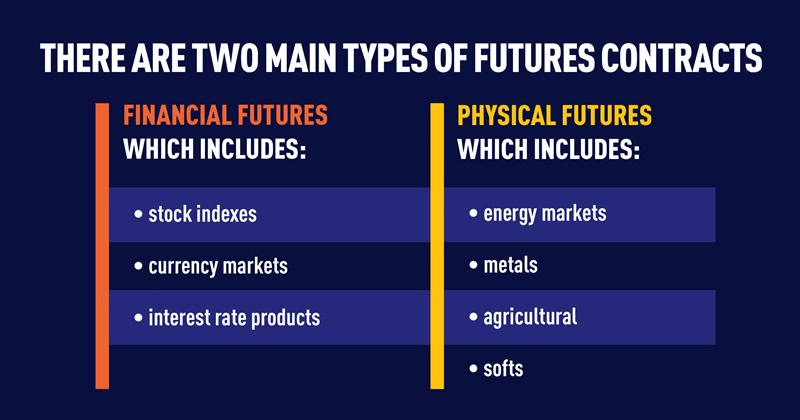

Futures trading presents a vast array of market opportunities. Whether you’re interested in energy commodities like oil and natural gas, agricultural products like wheat and soybeans, or financial instruments like stock index futures, there’s a market for almost every sector of the economy. These markets operate around the clock, allowing traders to capitalize on global events and news that impact prices.

Transition Words

To illustrate the possibilities, let’s take the example of an aspiring investor who believes that the price of crude oil will rise due to geopolitical tensions in the Middle East. Through futures trading, this individual can enter into a contract to buy oil at the current price with the expectation of selling it at a higher price in the future. If their prediction turns out to be accurate, they can generate substantial profits. However, it’s crucial to note that futures trading requires diligent monitoring and timely decision-making, as contracts have expiration dates and positions must be managed accordingly.

Conclusion

In conclusion, futures trading offers a dynamic and potentially lucrative avenue for investors to engage in the financial markets. By understanding the fundamental principles of futures trading, identifying market opportunities, and managing risk effectively, individuals can navigate this exciting landscape with confidence. However, it’s essential to remember that futures trading involves inherent risks, and success often hinges on a combination of knowledge, skill, and discipline. So, if you’re ready to dive into the world of futures trading, arm yourself with information, seek guidance when needed, and embrace the thrilling rollercoaster ride that is the financial market.