What Is a Liquid Asset? Defining Liquid Assets

What Is a Liquid Asset: Unveiling the Power of Financial Fluidity

In the ever-evolving world of finance, understanding key concepts is vital for any investor seeking to navigate the unpredictable tides of the market. One such concept that holds significant importance is the notion of a liquid asset. But what exactly does it mean? How does it impact your financial journey? In this article, we will delve into the depths of liquid assets, unravel their significance, and shed light on why they should be a cornerstone of your investment strategy.

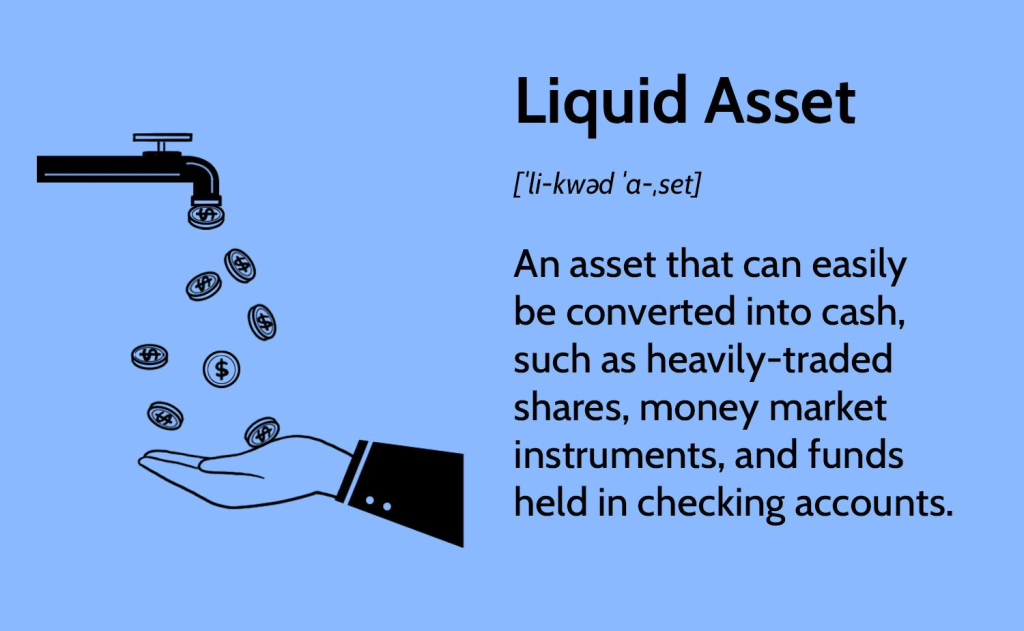

Defining Liquid Assets

At its core, a liquid asset is any asset that can be readily converted into cash without a significant loss in value. Think of it as a financial lifeline that allows you to swiftly tap into your funds when the need arises. These assets possess the unique quality of being easily traded, bought, or sold on the market, allowing investors to swiftly seize opportunities or meet unforeseen obligations.

The Power of Flexibility

Liquid assets offer a sense of financial flexibility that can prove invaluable in times of uncertainty. Picture yourself in a turbulent market scenario where prices are plunging, and panic is spreading like wildfire. Having a significant portion of your portfolio invested in liquid assets provides you with the ability to swiftly adapt to changing circumstances. When the tide turns, you can effortlessly convert these assets into other investments or seize the chance to scoop up undervalued opportunities.

The Spectrum of Liquid Assets

Liquid assets come in various forms, each with its own degree of liquidity. Let’s explore some common examples:

- Cash and Cash Equivalents: Money held in your savings account, checking account, or even stashed under your mattress, falls under this category. Cash is the epitome of liquidity, providing instant access to funds. It’s like having a financial Swiss Army knife always within arm’s reach.

- Marketable Securities: These include stocks, bonds, and mutual funds that can be readily bought or sold on established exchanges. Although they may not match the immediacy of cash, they still offer a high degree of liquidity, enabling investors to swiftly convert them into cash or other assets.

- Bank Deposits: Placing your money in a certificate of deposit (CD) or a money market account provides a balance between earning interest and maintaining liquidity. While these options may impose certain restrictions on withdrawals, they still remain highly accessible and can be converted into cash relatively quickly.

- Short-term Government Securities: Treasury bills, or T-bills, are debt obligations issued by the government with short maturities. They are considered one of the most liquid investments as they can be easily bought or sold on the secondary market, offering a safe haven during times of market turmoil.

Why Liquid Assets Matter

Having a well-diversified portfolio with a healthy allocation to liquid assets is crucial for several reasons:

Conclusion

In the vast ocean of finance, the concept of liquid assets serves as a life raft, ready to rescue investors from turbulent waters. By understanding the power and significance of liquid assets, you can strategically position yourself to weather the stormy seas of the market. Embrace financial fluidity, maintain a diversified portfolio, and let liquid assets be your trusted ally in your pursuit of financial prosperity. So, what is a liquid asset? It’s the key to unlocking the path to financial resilience and opportunity.