What Are Dividend Stocks?

Unraveling the Mystery: What Are Dividend Stocks?

Have you ever wondered what makes certain stocks more enticing than others? What if I told you there’s a type of stock that not only holds the potential for capital appreciation but also rewards you with regular cash payments? Enter the world of dividend stocks. In this article, we will delve into the fascinating realm of dividend stocks, explaining what they are, how they work, and why they might be a valuable addition to your investment portfolio.

Understanding Dividend Stocks

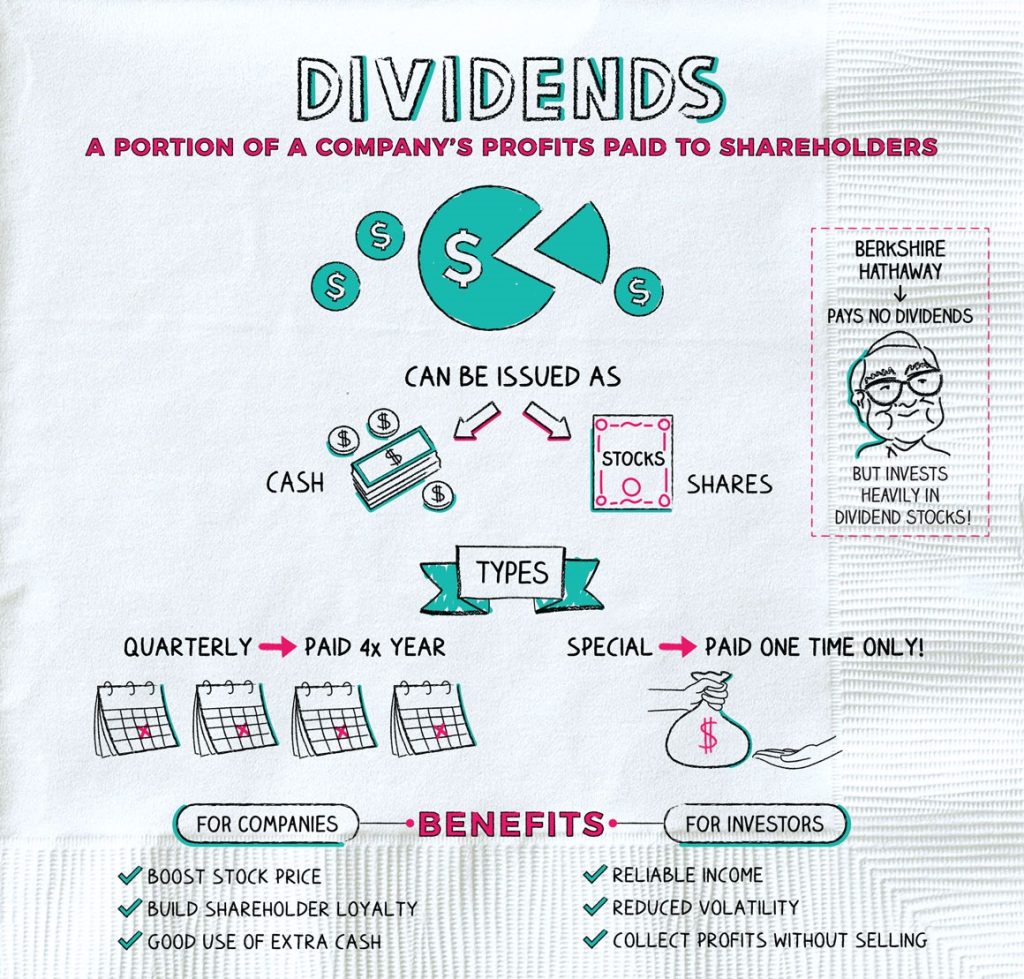

Dividend stocks, in simple terms, are shares of companies that distribute a portion of their earnings to shareholders as dividends. These dividends act as a financial reward, allowing investors to reap the benefits of their investment beyond mere price appreciation. Picture it like receiving a bonus for being a loyal shareholder in a successful company.

How Do Dividend Stocks Work?

When a company generates profits, it has several options on how to utilize those earnings. One common practice is to reinvest the profits back into the business to fuel growth. However, companies that pay dividends take a different approach. They distribute a portion of the earnings directly to their shareholders as cash payments, typically on a regular basis. These dividends can be a fixed amount per share or a percentage of the stock’s price, known as the dividend yield.

The Benefits of Dividend Stocks

Investing in dividend stocks can offer several advantages for investors seeking a steady income stream and long-term wealth accumulation. Let’s explore some of the key benefits:

- Regular Income: Dividend stocks provide a reliable source of income, especially for those looking to supplement their existing cash flow or save for retirement. By reinvesting these dividends, you can harness the power of compounding, potentially amplifying your returns over time.

- Stability in Volatile Markets: Dividend-paying companies tend to be more mature and established, often operating in sectors less prone to extreme market fluctuations. This stability can act as a cushion during times of economic uncertainty, providing a degree of protection for your investment. Potential for Growth: Although dividend stocks are known for their income-generating qualities, they can also offer the potential for capital appreciation. Reputable companies with a consistent track record of paying dividends often attract investors, driving up the stock price and potentially boosting the value of your investment.

Finding the Right Dividend Stocks:

While dividend stocks can be appealing, not all are created equal. Here are a few factors to consider when selecting dividend stocks for your portfolio: Dividend Yield: The dividend yield is a key metric that indicates the annual dividend payment as a percentage of the stock’s price. Higher yields generally imply a greater income potential, but it’s essential to assess the company’s ability to sustain those payouts. Dividend History: Researching a company’s dividend history provides valuable insights into its reliability and commitment to distributing dividends. Look for companies with a consistent track record of increasing or maintaining dividend payments over time. Financial Health: Analyzing a company’s financial health is crucial to determine its ability to sustain dividend payments. Evaluate metrics such as earnings growth, cash flow, and debt levels to gauge the company’s stability and profitability.

Conclusion

In a world where financial security and wealth creation are top priorities, understanding what dividend stocks are and how they work can be a game-changer for investors. These stocks offer the opportunity to earn regular income while potentially benefiting from capital appreciation. By selecting high-quality dividend-paying companies with solid financials, investors can navigate the stock market’s ups and downs with greater confidence. So, what are dividend stocks? They’re more than just stocks—they’re a doorway to a rewarding investment strategy that can help you achieve your financial goals.