What Is a Global Index Tracker? How a Global Index Tracker Works

What Is a Global Index Tracker? Unleashing the Power of Worldwide Investments

In the vast and intricate world of finance, navigating the global markets can often seem like a daunting task. However, armed with the right tools and knowledge, even the most novice investors can take part in this thrilling adventure. One such tool that has gained popularity over the years is the global index tracker. So, what is a global index tracker, you may ask? Let’s dive in and unravel this concept to understand its significance and potential benefits.

Defining the Global Index Tracker

A global index tracker, in simple terms, is an investment vehicle designed to mirror the performance of a specific global market index. These indices are benchmarks that measure the overall performance of a group of stocks or other assets within a particular market or sector. Global index trackers are a type of exchange-traded fund (ETF) that aims to replicate the performance of a chosen index, allowing investors to gain exposure to a diversified portfolio without having to buy each individual stock.

Understanding the Purpose and Significance

The primary purpose of a global index tracker is to provide investors with a broad representation of a specific market or sector’s performance. It acts as a barometer, reflecting the collective sentiment of investors and offering valuable insights into the overall health of the global economy. By tracking a well-known index like the S&P 500 or the MSCI World Index, investors can gauge the pulse of the markets and make informed decisions based on trends and patterns. A global index tracker offers several advantages over other investment options. First and foremost, it provides instant diversification by including a wide range of stocks from various sectors and regions. This diversification helps mitigate risks associated with investing in individual companies or sectors, spreading the risk across the entire market. Additionally, global index trackers are typically passively managed, meaning they have lower expense ratios compared to actively managed funds, resulting in potentially higher returns for investors.

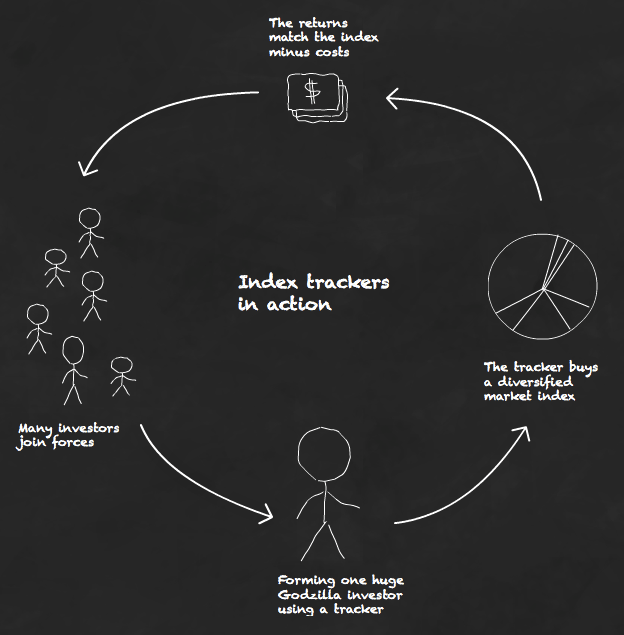

How a Global Index Tracker Works

Global index trackers function by replicating the holdings and weightings of the underlying index they aim to track. The fund managers employ a range of strategies to achieve this objective, such as purchasing the constituent stocks in the same proportions as the index or using derivatives to mimic the index’s performance. As an investor, when you buy shares of a global index tracker, you effectively own a small piece of all the stocks within that particular index. Consequently, as the index’s value fluctuates, so does the value of your investment. For instance, if the tracked index experiences a positive performance, the value of your investment in the global index tracker will likely increase. Conversely, if the index experiences a downturn, your investment value may decline.

Why Invest in a Global Index Tracker

Investing in a global index tracker can be a prudent choice for both novice and seasoned investors alike. For beginners, it offers a simple and accessible way to gain exposure to the global markets without requiring in-depth knowledge or extensive research. The diversification provided by a global index tracker also helps minimize the impact of individual stock volatility, making it a less risky option. Furthermore, investing in global index trackers can serve as a long-term wealth-building strategy. Historically, the global markets have shown resilience and growth over time, making these investment vehicles ideal for individuals with a long investment horizon. Moreover, the low expense ratios associated with index trackers translate into more significant returns for investors over the long run.

Conclusion

In conclusion, a global index tracker is a powerful tool that allows investors to participate in the global markets by mirroring the performance of a specific index. It offers instant diversification, lower expense ratios, and insights into the overall health of the markets. Whether you’re a novice investor starting your journey or a seasoned trader looking to expand your portfolio, a global index tracker can be a valuable addition to your investment strategy. By harnessing the power of this financial instrument, you can take part in the exhilarating world of global finance and potentially reap the rewards it has to offer. So, what is a global index tracker? It’s your passport to the pulse of the global market, guiding you through the highs and lows, and paving the way towards financial success.