What Is an Index Fund? Understanding the Basics

What Is an Index Fund? A Beginner’s Guide to Navigating the Stock Market

If you’re new to the world of investing, you’ve probably come across the term “index fund” more than once. But what exactly is an index fund, and why should it matter to you? In this article, we’ll dive into the depths of index funds, demystify the jargon, and shed light on why they can be a smart choice for both seasoned investors and beginners alike.

Understanding the Basics

Let’s start with the basics. An index fund is a type of investment fund that aims to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. It’s like buying a basket of stocks that mirror the composition of the chosen index, providing you with broad exposure to the overall market or a specific sector.

The Beauty of Simplicity

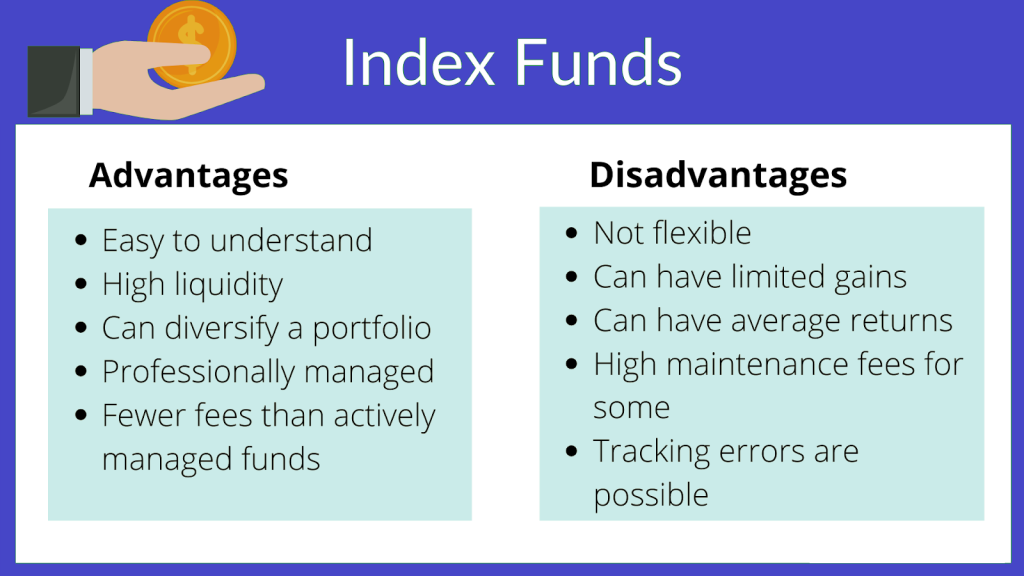

One of the key advantages of index funds lies in their simplicity. They follow a passive investment strategy, meaning they don’t rely on the skill or expertise of a fund manager to handpick individual stocks. Instead, they aim to match the performance of the underlying index by holding the same stocks in the same proportion as the index itself. This “set it and forget it” approach offers several benefits. First, it eliminates the need for you to constantly monitor and analyze individual stocks. Second, it helps reduce the costs typically associated with actively managed funds, as index funds have lower expense ratios. And finally, it mitigates the risk of underperforming the market, as active fund managers often struggle to consistently beat their benchmarks.

The Power of Diversification

Diversification is a crucial concept in investing, and index funds excel in this regard. By investing in an index fund, you gain exposure to a wide range of companies within a particular index. This diversification helps spread your investment across multiple stocks, reducing the impact of any single company’s poor performance on your overall portfolio. For instance, let’s say you invest in an index fund that tracks the S&P 500. Instead of placing all your eggs in one basket by investing in a single stock, you’ll hold a small piece of 500 different companies. This diversification can help smooth out the volatility and increase the stability of your investment returns over time.

Low Costs and Accessibility

Another compelling aspect of index funds is their affordability and accessibility. Since they operate passively, they incur lower management fees compared to actively managed funds. These lower expenses can have a significant impact on your investment returns over the long term. Additionally, index funds are available in various investment vehicles, such as mutual funds and exchange-traded funds (ETFs), making them accessible to investors with different preferences and account sizes.

Index Funds: A Tool for Long-Term Success

While index funds are not immune to market fluctuations, they have consistently demonstrated their ability to generate solid long-term returns. By capturing the overall growth of the market, they offer a sensible and reliable approach to building wealth over time. Many financial experts recommend including index funds as a core component of a well-diversified investment portfolio.

Conclusion

So, what is an index fund? It’s a straightforward investment vehicle that mirrors the performance of a market index, providing broad exposure to the stock market or a specific sector. With their simplicity, low costs, diversification benefits, and accessibility, index funds offer an attractive investment option for those looking to grow their wealth steadily and minimize the need for active management. Whether you’re a seasoned investor or just starting your investment journey, considering index funds as part of your portfolio strategy can be a wise decision. Remember, building wealth is a marathon, not a sprint, and index funds can help you stay on the right track toward your financial goals.