What is Equity in Forex? Unveiling the Mystery

Unveiling the Mystery: What is Equity in Forex?

If you’re new to the world of forex trading, you’ve probably come across the term “equity” more times than you can count. It’s a word that holds significant importance and can greatly impact your trading journey. But what exactly is equity in forex, and why should you care? In this article, we’ll demystify this concept, shed light on its significance, and help you understand how it can influence your trading outcomes.

Understanding Equity: It’s More Than Just a Buzzword

Equity, in the context of forex trading, refers to the value of your trading account after taking into account your open positions and profits or losses. Think of it as the stake you hold in the forex market. It’s the amount of money you would have left if you were to close all your trades at their current market prices. To put it simply, equity is the reflection of your trading success or failure. It determines your net worth within the forex market, indicating whether you’re making profits or facing losses. Monitoring and managing your equity is crucial to gauging your trading performance and making informed decisions.

Equity vs. Balance: A Crucial Distinction

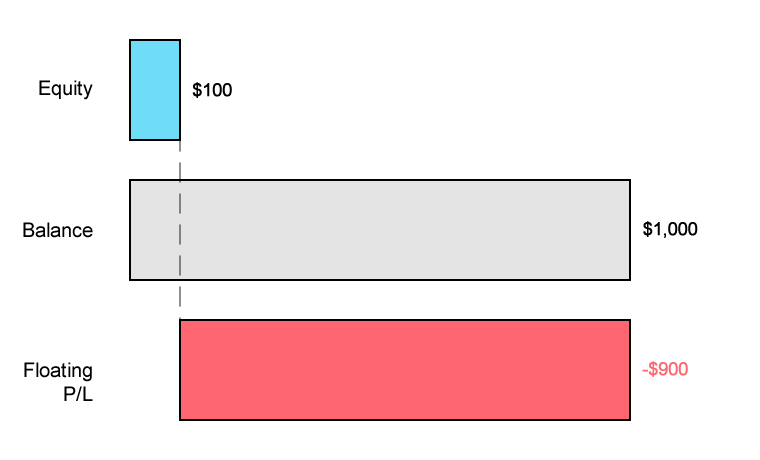

Before we dive deeper into equity, let’s clarify an important distinction: the difference between equity and balance. While these terms are related, they represent distinct aspects of your trading account. Balance refers to the total amount of money you have in your trading account, including both open and closed trades. On the other hand, equity takes into account the unrealized profits or losses from your open positions, providing a real-time snapshot of your account’s value. For instance, let’s say you start with a trading account balance of $10,000. If you open a trade and it starts generating profits, your equity will increase accordingly. However, if the trade turns against you and incurs losses, your equity will decrease, affecting your overall account value.

Calculating Equity: The Formula Behind the Numbers

Now that we have a clearer understanding of equity, let’s delve into how it’s calculated. The formula for equity is relatively straightforward: Equity = Balance + Floating Profits – Floating Losses Floating profits and losses refer to the unrealized gains or losses from your open positions. These figures change in real-time as market prices fluctuate, impacting your equity accordingly. By keeping an eye on your equity, you can assess your trading performance and make informed decisions about when to close or adjust your trades.

Managing Equity: A Key to Long-Term Success

Managing Equity: A Key to Long-Term Success

As a forex trader, it’s crucial to actively manage your equity to safeguard your trading capital and maximize your potential profits. Here are a few essential tips to help you manage your equity effectively:

- Implement Proper Risk Management: Set appropriate stop-loss orders to limit potential losses and protect your equity from significant downturns. Never risk more than you can afford to lose.

- Regularly Review and Adjust Your Trades: Monitor your open positions regularly, assessing their progress and adjusting your strategies as needed. Don’t hesitate to close a trade if it’s not performing as expected or if market conditions change.

- Diversify Your Portfolio: Spread your investments across different currency pairs and avoid putting all your eggs in one basket. Diversification can help mitigate risk and protect your equity from the impact of a single trade.

- Continuously Educate Yourself: Stay updated with market trends, economic news, and trading strategies. The more knowledge you acquire, the better equipped you’ll be to make informed decisions that positively impact your equity.

Conclusion

Equity is a fundamental concept in forex trading, representing the real-time value of your account after accounting for open positions and profits or losses. It serves as a crucial metric for evaluating your