What is leverage in forex? The Power of Leverage

Demystifying Leverage in Forex: Amplifying Potential Gains and Risks

Introduction

If you’ve ever dabbled in the world of forex trading, chances are you’ve come across the term “leverage.” While it might sound like a complicated concept, leverage is actually a powerful tool that can amplify both your potential gains and losses in the forex market. In this article, we will demystify leverage, explain how it works, and highlight its pros and cons. So, fasten your seatbelts as we embark on a journey to understand the ins and outs of leverage in forex.

Understanding Leverage

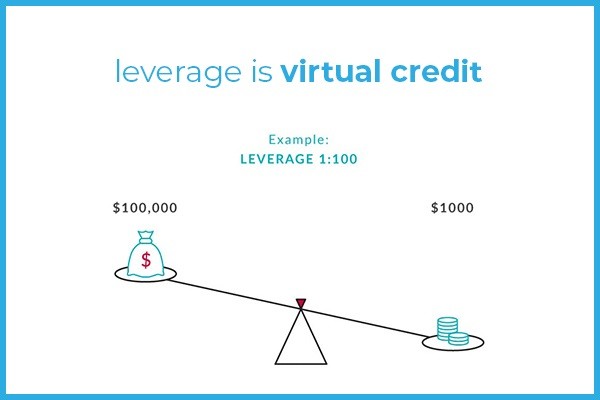

At its core, leverage is like a financial magnifying glass. It enables traders to control larger positions in the market with a smaller amount of capital. In other words, it allows you to borrow money from your broker to open positions that exceed the funds you have in your trading account. It’s akin to getting a financial boost to potentially amplify your profits. However, it’s crucial to remember that just as leverage can magnify your gains, it can also exponentially increase your losses.

The Power of Leverage

Let’s take a hypothetical example to illustrate the power of leverage. Imagine you have $1,000 in your trading account and your broker offers you a leverage ratio of 1:100. This means that for every dollar you have in your account, you can control $100 in the forex market. With this leverage, you can open a position worth $100,000 (100 times the amount you actually have), which gives you the potential to earn profits based on the full value of that position.

Profit Potential vs. Risk

Leverage can certainly be a double-edged sword, amplifying not only your potential gains but also your potential losses. While it can skyrocket your profits during successful trades, it can also quickly deplete your trading account if the market moves against you. Therefore, it’s crucial to exercise caution and implement risk management strategies when utilizing leverage.

Risk Management: A Key Ingredient

To mitigate the risks associated with leverage, it’s essential to have a robust risk management plan in place. This includes setting stop-loss orders, which automatically close your position if the market moves in an unfavorable direction beyond a predetermined level. Additionally, diversifying your trades, using proper position sizing, and conducting thorough market analysis can help you navigate the forex market more effectively.