What is Leverage in Forex? Understanding Leverage

Understanding Leverage in Forex: Amplifying Your Trading Potential

In the vast world of forex trading, where currencies fluctuate and fortunes are made, it’s essential to equip yourself with the right knowledge and tools to navigate the ever-changing market. One such tool is leverage, a powerful mechanism that can significantly amplify your trading potential. In this article, we will delve into the concept of leverage in forex and explore how it can enhance your trading experience while also highlighting potential risks.

What is Leverage in Forex?

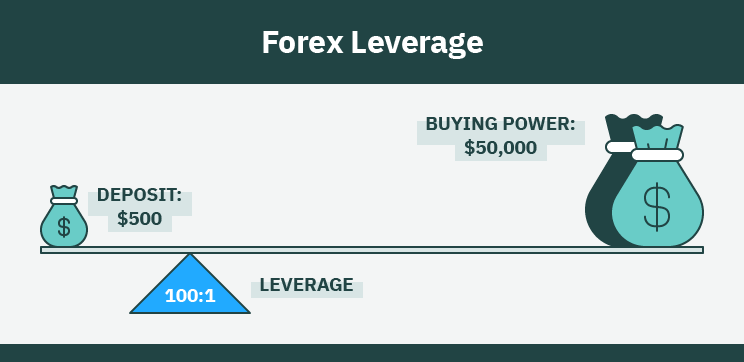

Leverage, in simple terms, can be likened to a magnifying glass for your trading capital. It allows you to control a larger position in the market with a relatively smaller investment. For instance, with a leverage of 1:100, you can control $100,000 worth of currency with just $1,000 in your trading account. This ability to trade with borrowed funds can potentially lead to higher profits, but it comes with its fair share of risks.

Leverage: The Double-Edged Sword

- Amplifying Gains:

- Increased Exposure:

Risk Management: A Key Component

In the world of forex trading, risk management is paramount. Leverage can tempt traders to take on more significant positions than they can afford, which can be a recipe for disaster. Here are a few risk management techniques to consider:

- Set Stop-Loss Orders:

- Use Proper Position Sizing:

- Stay Informed and Educated:

Conclusion

Leverage in forex is a powerful tool that can enhance your trading potential, allowing you to control larger positions in the market. However, it’s crucial to approach leverage with caution and employ effective risk management strategies. While the potential for higher profits exists, the risk of significant losses also looms large. Remember, successful trading requires a balance of knowledge, discipline, and risk management. So, as you embark on your forex trading journey, always tread carefully, keeping leverage in perspective, and stay focused on your long-term trading goals.